The 4Q21 ISG Index call is Monday, January 10 at 9:00 AM EST. We hope to see you there as we recap the unprecedented year that was 2021 and forecast what’s in store for 2022.

Register here.

Did someone forward you this briefing? If so, subscribe here to get a copy of the Insider in your inbox each Friday.

M&A ACTIVITY

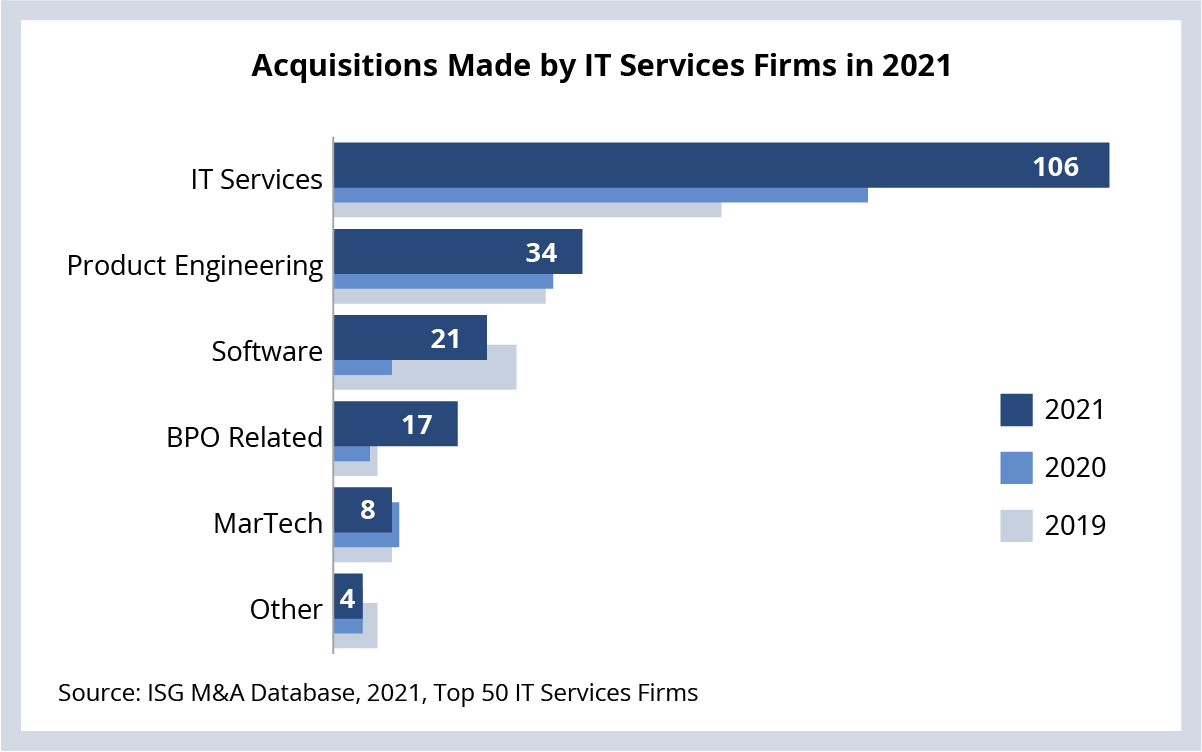

2021 was a record year for M&A in the IT services industry. There were 47% more deals in 2021 than in 2020, and the value of those deals was up 63%. Excess capital saved up during the pandemic, low interest rates and strong demand for digital transformation capabilities were the key drivers that led to this record-breaking year.

Accenture, Deloitte, IBM, Atos and Tech Mahindra were the most active in 2021; they primarily targeted other IT services firms (see Data Watch). Within this segment we’re primarily talking about cloud engineering, cybersecurity and analytics – capabilities that are in super high demand as companies accelerate their digital transformation initiatives.

And let’s not forget about the role of private equity in technology M&A. In 2021, PE firms accounted for seven $1B+ transactions. For example, KKR acquired ISG Leaderboard provider Ensono; I Squared Capital acquired KIO Networks, Mexico’s largest data center operator; and just before the end of the year, Advent International acquired digital engineering firm Encora.

DATA WATCH

M&A ACTIVITY

- Oracle makes its biggest-ever acquisition with the purchase of healthcare tech and services firm Cerner (link, ISG POV).

- Genpact acquires Adobe user-experience specialist Hoodoo Digital (link).

- Infogain acquiring cloud-native app development company NNT (link).

- NTT DATA acquires supply chain and analytics services firm Chainalytics (link).

- Tech Mahindra acquires Seattle-based IT services firm Allyis India (link).

- Wipro acquiring Austin-based cybersecurity firm Edgile (link).

- Accenture acquires Dutch sustainability firm Zestgroup (link).

- Conduent selling its patient safety and quality solutions to healthcare provider symplr (link).

- Digital Realty acquiring majority stake in African colocation provider Teraco (link).