Hello. This is Stanton Jones with what’s important in the IT and business services industry this week.

If someone forwarded you this briefing, consider subscribing here.

Hiring

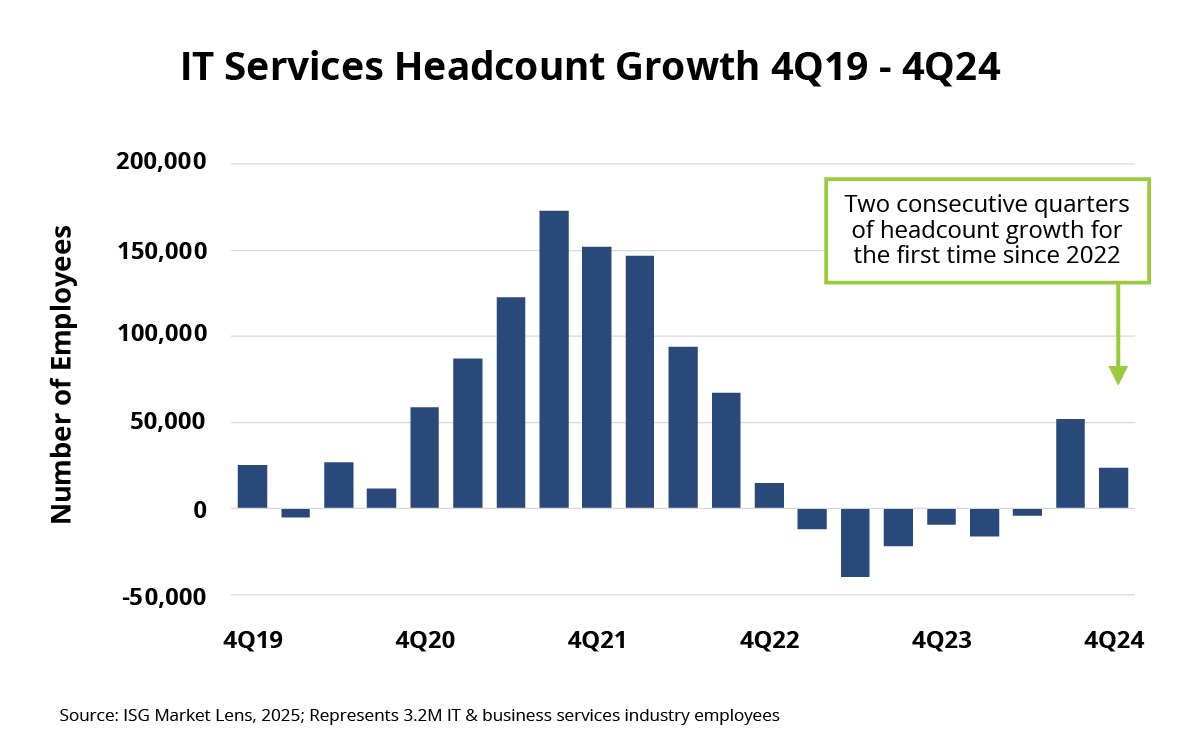

The IT and business services industry saw two consecutive quarters of headcount growth for the first time since 2022; still, hiring remains cautious as the industry grapples with uncertainty in enterprise demand.

Data Watch

Background

Back in August of 2024, we identified an inflection point in the industry: revenue growth passed headcount growth for the first time since 2021. Our point of view was that this was due to rising utilization levels across the industry. Essentially, providers’ capacity was “at capacity.”

Based on this, we projected that hiring would start to pick up in the IT and business services industry. That prediction came to fruition in the third quarter of last year, when the industry saw its first increase in headcount growth in over a year and half.

As you can see in this week’s Data Watch, that growth trend continued in 4Q24, making it the first time since 2022 that the industry has seen consecutive quarter headcount growth.

The Details

- Headcount increased by 23,000 in Q4, compared to 52,000 in 3Q24.

- The industry is 1% smaller by headcount than it was in 4Q22, however, revenue grew by 7% over the same time period.

What’s Next

Consecutive quarters of headcount growth are a great sign for the industry, but it’s important to keep in mind that many service providers are just maintaining their current staffing levels. Only a handful added headcount in Q3 and Q4.

We think that will start to change in 2025 as we’re forecasting 4.5% growth in 2025, stronger than last year. Providers will need to add headcount to keep up with this new demand, even as generative AI starts to decrease the effort (by 50%, in some cases) to get work done.

As headcount growth returns, we also expect attrition to increase. As a result, providers that added headcount in anticipation of growth will be better positioned to address the return of discretionary spending and the expansion of their existing managed services relationships.