Hello. This is Michael Dornan and Alex Bakker with what’s important in the IT and business services industry this week.

If someone forwarded you this briefing, consider subscribing here.

Digital Sustainability

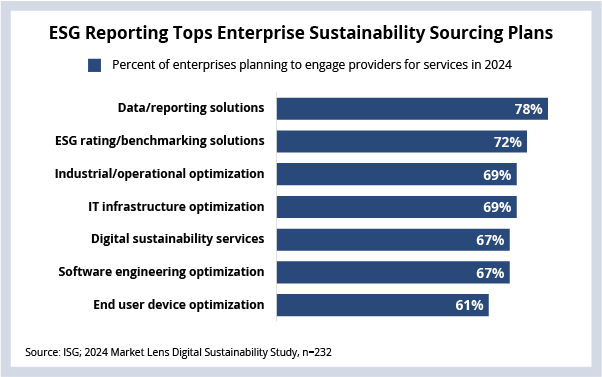

Digital sustainability – the use of technology and associated services to improve an organization’s sustainability – is on the rise. Our most recent Market Lens study shows that enterprise spending on sustainability is seen as a necessity, with companies allocating around $1 of every $500 of revenue to sustainability initiatives. Enterprises plan to direct more of this investment on reporting and compliance services than infrastructure such as cloud or network modernization.

Background

The term “sustainability” covers decision-making and practices that support an organization’s environmental, social and governance (ESG) values. American companies have tended to lag behind their EMEA counterparts in environmental sustainability investments but have forged ahead in the governance component, particularly in terms of data privacy and security. This is in part because the reasons for these investments vary from region to region, with American companies focused on meeting their third-party compliance criteria and EMEA-based companies focused on accurate reporting of complex environmental data. Service providers have become crucial partners in areas such as IT infrastructure efficiency, data privacy and other reporting related to ESG.

The Details

- Enterprises are expected to spend 35% of their total sustainability spending this year on digital sustainability.

- ESG reporting is the number one sustainability spending priority for enterprises, but only 43% are using a dedicated ESG reporting and analytics solution, and around one-third of enterprises admit their organization has insufficient knowledge of the reporting and benchmarking solutions in the market.

- 74% of enterprises feel they are short on sustainability skills and expertise to meet their organizations’ needs by 2026.

What To Expect in 2024

Unlike many other investments, digital sustainability’s tie to the bottom line is often more tenuous, driven by necessity rather than direct business gain. Executives responsible for sustainability initiatives need to be able to measure the progress of their sustainability investments and align their expenditures to both financial and sustainability goals. Many need support on this journey, especially in the collection and reporting of these metrics.

As organizations struggle to support customized reporting/benchmarking solutions and sustainability services, we expect to see greater opportunity for service providers that can turn what is currently a measurement-and-reporting exercise into a strategic-insights feed to support enterprise decision-making.

Enterprises will lean on provider expertise to connect the dots between the specific sustainability and reporting goals of their organization, the evolving nature of the regulatory environment and the compliance risks associated with the complexity of the data feeds they are using.

We expect spending on digital sustainability to grow by 3-5% this year, even though the cost of sustainability services is the top challenge for enterprises. The demands of reporting and compliance and the lack of internal talent mean that demand for third-party support will continue to increase – especially as the costs of non-compliance and the complexity of global regulations grow.