Hello. This is Alex Bakker standing in for Stanton Jones with what’s important in the IT and business services industry this week. Please join me for the ISG Index 4Q25 call next Thursday, January 15 at 9am ET. You can register here.

If someone forwarded you this briefing, consider subscribing here.

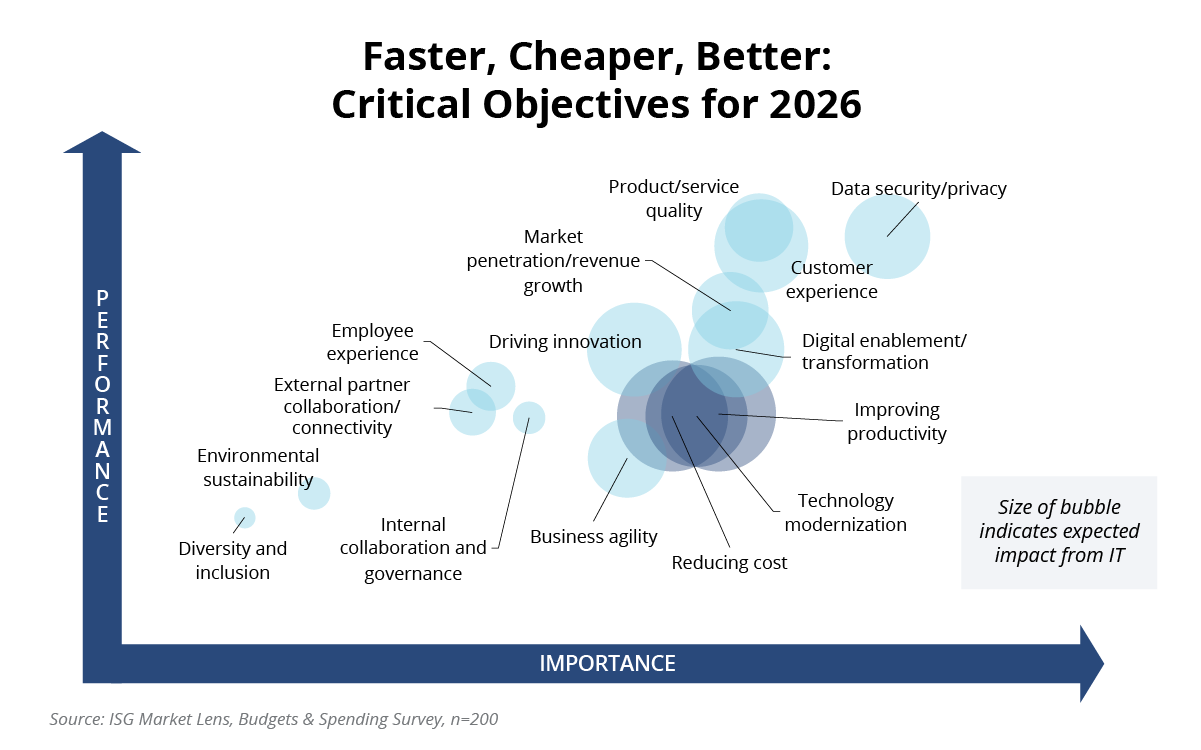

Faster, Cheaper, Now Better

- Relative performance on cost reduction has improved for most organizations.

- Technology modernization is performing worse relative to other areas.

Data Watch

2026 Priority

The most striking finding here is that the three objectives in the lower right — technology modernization, cost reduction and improving productivity — are also the three areas where IT is expected to have the biggest impact. The lower-right quadrant in the chart contains objectives that are of high importance but are performing relatively poorly.

Like last year, IT budgets are expected to remain relatively flat, with growth in certain categories, such as AI and cybersecurity, reflecting shifts in allocation rather than overall increases in spending. In that context, the low performance of these three high-impact areas indicates that IT remains under extreme pressure to deliver more direct value to the business. It also suggests that most organizations believe additional spending will not deliver explicit ROI.

Still, compared to last year, the situation is more positive for IT. Here’s why:

- Productivity still leads as a priority. For most organizations, this takes the shape of AI adoption. Even amid pressure to control costs, businesses still expect technology to be the primary driver of productivity. We often highlight that the measure of productivity is the rate of output per dollar or per unit of time. As AI drives impact on output, productivity improves overall, and AI adoption remains high on the list for enterprise IT.

- Cost controls have worked. Improved performance in cost reduction indicates that changes made over the past year to control costs have been effective. IT is on a trajectory to do more with existing budgets as cost savings are redeployed into new programs. All cost reductions effectively improve net productivity, creating a virtuous cycle.

- Declining performance in technology modernization may be the best news in the study. Last year, organizations perceived that technology modernization was performing at or above peer levels and that IT should de-prioritize it. But, in reality, the combination of its declining performance and higher importance indicates that organizations understand the impact that technical debt and legacy applications have on their productivity and cost. Many organizations have also realized that data quality issues and technical debt are major inhibitors to getting AI into production. That realization is driving poorer performance evaluations, but increased IT attention on technology modernization has the potential to both reduce costs and increase productivity.

The ISG Index Team and I look forward to seeing you on the ISG Index 4Q25 call next Thursday, January 15 at 9am ET, when we will discuss these findings and more. Make sure to reserve your spot here.